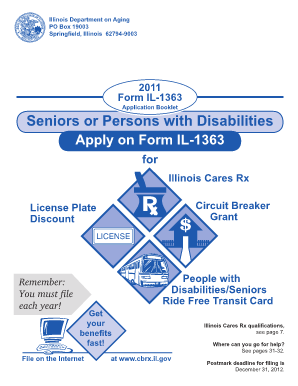

IL Form IL-1363-X 2011-2024 free printable template

Show details

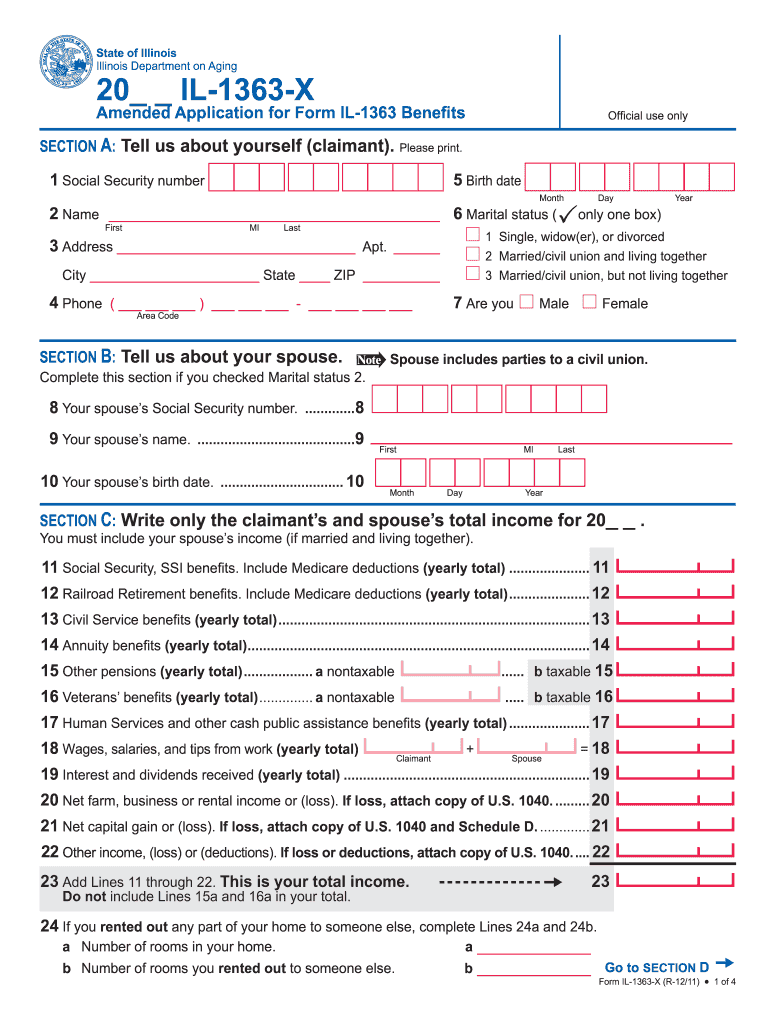

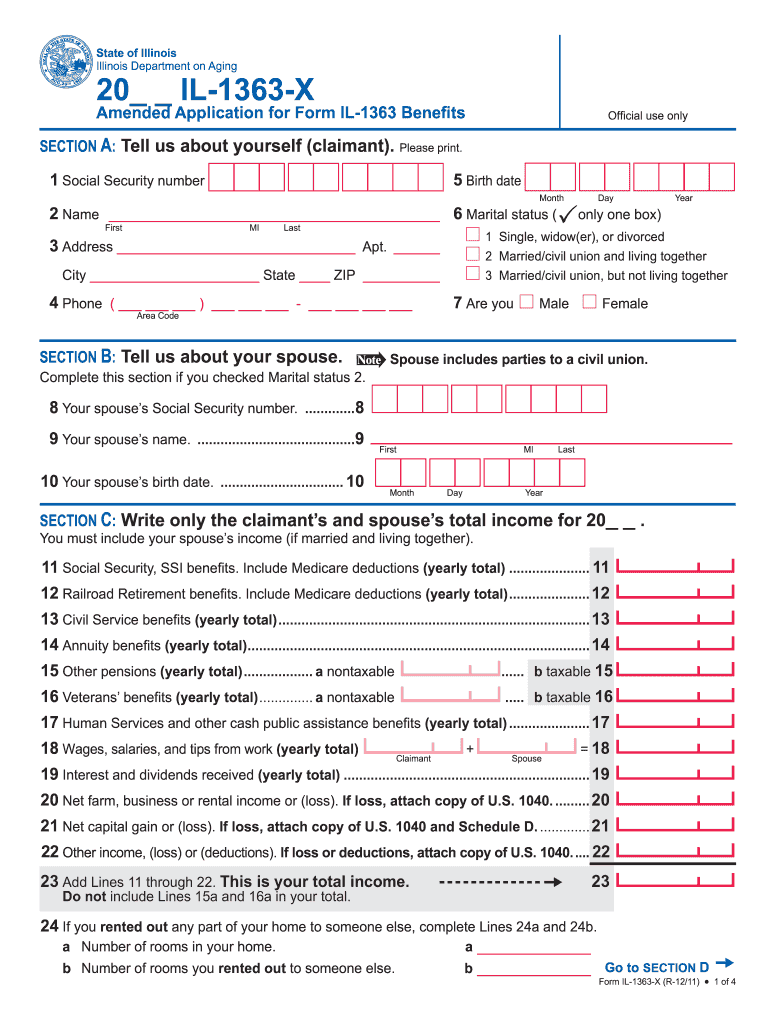

IL-402-1098 Line-by-line instructions for Form IL-1363-X Who should file Form IL-1363-X 2008 2009 2010 or 2011. State of Illinois Illinois Department on Aging 20 IL-1363-X Amended Application for Form IL-1363 Benefits SECTION A Tell us about yourself claimant. O. Box 19003 Springfield Il 62794-9003 IOCI 0853-11 2 of 4 Form IL-1363-X R-12/11 Preparer s name Please print or type. 31 You the claimant must sign and date this form. 32 If you are married and living with your spouse your spouse...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your il 1363 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your il 1363 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing il 1363 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit you il 1363 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out il 1363 form

How to fill out il 1363 form:

01

Start by obtaining the il 1363 form from the appropriate source.

02

Carefully read the instructions provided with the form to understand the requirements and any supporting documentation needed.

03

Begin by entering your personal information, such as your full name, address, and contact details, in the designated fields.

04

Provide the necessary information about your tax obligations, including your Social Security number and any applicable tax identification numbers.

05

Indicate the type of tax return you are submitting and the tax year to which it corresponds.

06

Report your income accurately by including details of all sources of revenue, such as salaries, dividends, or rental income.

07

Deduct any eligible expenses or exemptions from your total income to calculate your taxable income.

08

Calculate the amount of tax owed or refund due based on the provided tax tables and guidelines.

09

Sign and date the form to certify the accuracy of the information provided.

10

Make a copy of the completed form for your records and submit the original to the relevant tax authority by the specified deadline.

Who needs il 1363 form?

01

Individuals who are required to file state taxes in Illinois.

02

Taxpayers who have had income earned in Illinois during the tax year.

03

Residents of Illinois with taxable income above the designated threshold determined by the state tax authority.

Fill file a il 1363 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is il 1363 form?

The IL 1363 form is a form used by the Illinois Department of Revenue to calculate an individual’s estimated income tax liability. It is used to estimate and report income, deductions, and credits to the state. The form is also used to determine an individual's estimated tax liability for the current year.

What is the purpose of il 1363 form?

The IL 1363 form is used to certify a student's Illinois residency for tuition purposes. It is used to document all the required information needed to establish residency in the state.

When is the deadline to file il 1363 form in 2023?

The deadline to file Form IL-1363 for the 2023 tax year is April 15, 2024.

What is the penalty for the late filing of il 1363 form?

The penalty for late filing of an Illinois Form 1363 is a penalty of 10% of the amount due or $100, whichever is greater, plus interest.

Who is required to file il 1363 form?

In the United States, the IL-1363 form is specific to the state of Illinois and is used for filing an S-Corporation Election. S-Corporations are required to file this form to elect their corporation to be treated as an S-Corporation for federal and state tax purposes. Therefore, only entities that wish to be treated as an S-Corporation in Illinois are required to file the IL-1363 form.

How to fill out il 1363 form?

The IL 1363 form is a Certificate of Tax Paid or a copy of a Certificate of Registration for the payment of tax by a registered motor vehicle in the state of Illinois. Here are the steps to fill out the IL 1363 form:

1. Download the IL 1363 form from the official website of the Illinois Secretary of State or obtain a physical copy from a local Secretary of State facility.

2. Start by filling out the top section of the form, which includes your name, address, city, state, ZIP code, and county.

3. Enter the year for which you are requesting the Certificate of Tax Paid. This should be the year for which you paid the tax and want proof of payment.

4. Provide the Vehicle Identification Number (VIN) of the registered motor vehicle for which you are requesting the certificate. The VIN can usually be found on the vehicle title or registration card.

5. Indicate whether you are requesting a certificate for a motor vehicle or a motorcycle by marking the appropriate checkbox.

6. If you are applying for a motorcycle certificate, provide the number of cylinders and the cubic centimeter (CC) displacement of the motorcycle's engine.

7. Sign and date the form at the bottom.

8. Make a copy of the completed IL 1363 form for your records.

9. Submit the original form to any Illinois Secretary of State facility or mail it to the following address:

Illinois Secretary of State

Vehicle Services Department

501 S. 2nd St., Rm. 011

Springfield, IL 62756

10. If submitting by mail, it is recommended to enclose a self-addressed stamped envelope, so that the completed certificate can be mailed back to you.

Note: Ensure you have paid the required tax for the registered vehicle before requesting the certificate.

What information must be reported on il 1363 form?

The IL-1363 form is a declaration of estimated tax that taxpayers in Illinois must file if they expect to owe $500 or more in income tax for the year and will not have sufficient withholding to cover the amount owed. The form requires the following information to be reported:

1. Taxpayer information: Personal details such as name, address, Social Security number, and filing status.

2. Estimated tax liability: Estimated income, deductions, exemptions, and other tax-related information for the current tax year.

3. Income tax payments and credits: Details of any tax withheld from wages, estimated tax payments made, and any credits that will be claimed.

4. Income tax computation: Calculation of the estimated income tax due, taking into account the information provided in sections 2 and 3.

5. Declaration and signature: The taxpayer must sign the form, certifying that the information provided is true and accurate to the best of their knowledge.

It is important to note that the IL-1363 form is used only for estimated tax purposes and does not replace the individual income tax return (IL-1040) that must be filed at the end of the tax year.

How can I edit il 1363 form from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including you il 1363 form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out circuit breaker form 1363 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign il 1363 circuit breaker application and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I fill out il 1363 online form on an Android device?

Complete il 1363 form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your il 1363 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Circuit Breaker Form 1363 is not the form you're looking for?Search for another form here.

Keywords relevant to 2018 form il 1363

Related to illinois form il 1363

If you believe that this page should be taken down, please follow our DMCA take down process

here

.